trust capital gains tax rate 2020

20 for trustees or for personal representatives of someone who. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35. This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT. The 0 and 15 rates continue to apply to certain threshold.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The maximum tax rate for long-term capital gains and qualified dividends is 20.

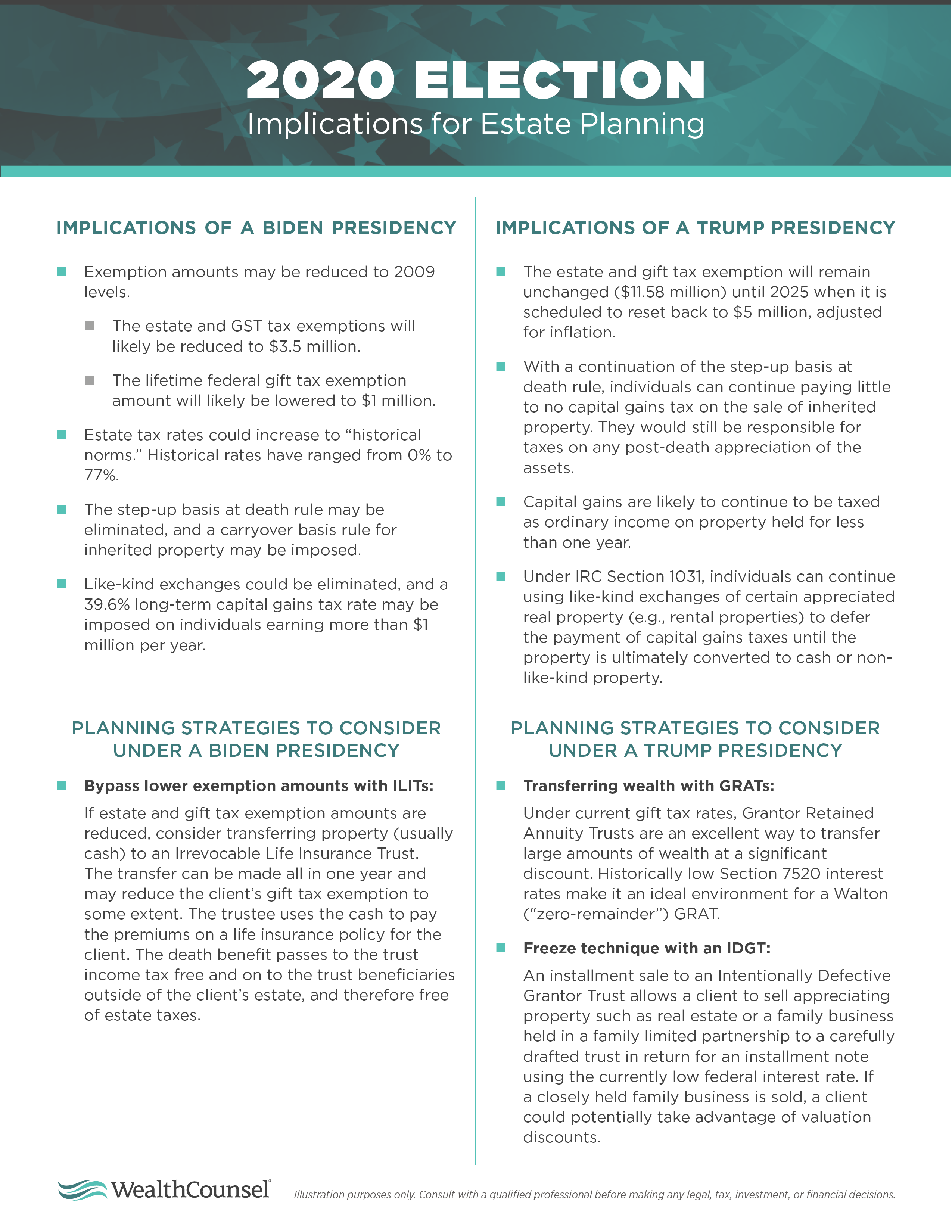

Rates allowances and duties have been updated for the tax year 2019 to 2020. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Senator Sanders has filed the For the 998 Act which would lower exemptions to and substantially raise the rates.

They would apply to the tax return filed in. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. This means youll pay 30 in Capital Gains.

The remaining amount is taxed at the current rate. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. Estate value between 35 million and 100 million 45 Estate.

Events that trigger a disposal include a sale donation exchange loss death and emigration. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250.

It also deals with situations where a person disposes of an interest in a settlement. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. The trustee of an irrevocable trust has discretion to distribute income including capital gains.

Trust tax rates are very high as you can see here. The form and notes have been added for tax year 2018 to 2019. Capital gains and qualified dividends.

The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income 100 net capital gain because the. For tax year 2020 the 20 rate applies to amounts above 13150. Capital gains tax rates on most assets held for less than a year correspond.

For example if you were to start a company from scratch and then sell it for 10 million depending on which state you lived in you may have a 20 to 37 capital gains tax to. 2022 Long-Term Capital Gains Trust Tax Rates. The following are some of the specific exclusions.

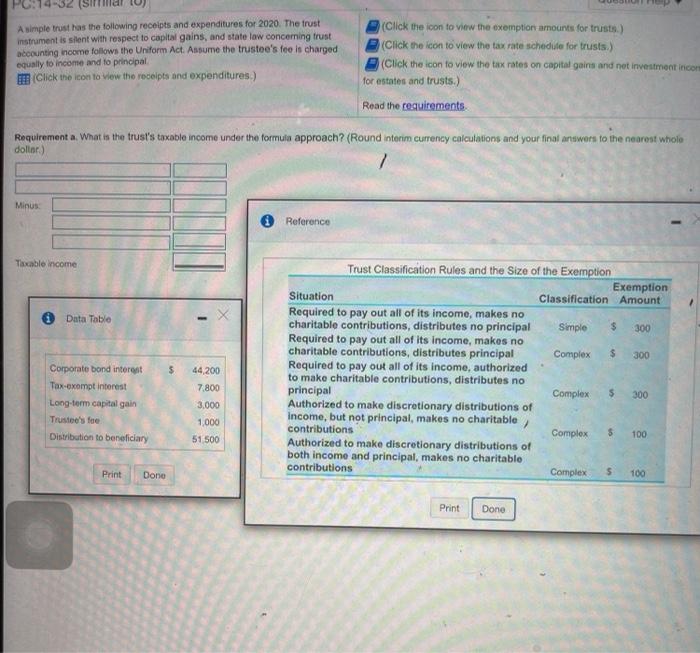

It continues to be important to obtain date of. The trust has the following 2020 sources of income and deduction.

Question Help Pc 14 32 Similar To A Simple Trust As Chegg Com

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Year End Charitable Tax Planning By Syed Nishat Wallstreet Alliance Group

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

4 Election Year Tax Strategies You And Your Clients Need To Consider

Saving State Income Taxes On Trusts Preservation Family Wealth Protection Planning

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

How Are Capital Gains Taxed Tax Policy Center

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Solved Can You Avoid Capital Gains Taxes On A Second Home

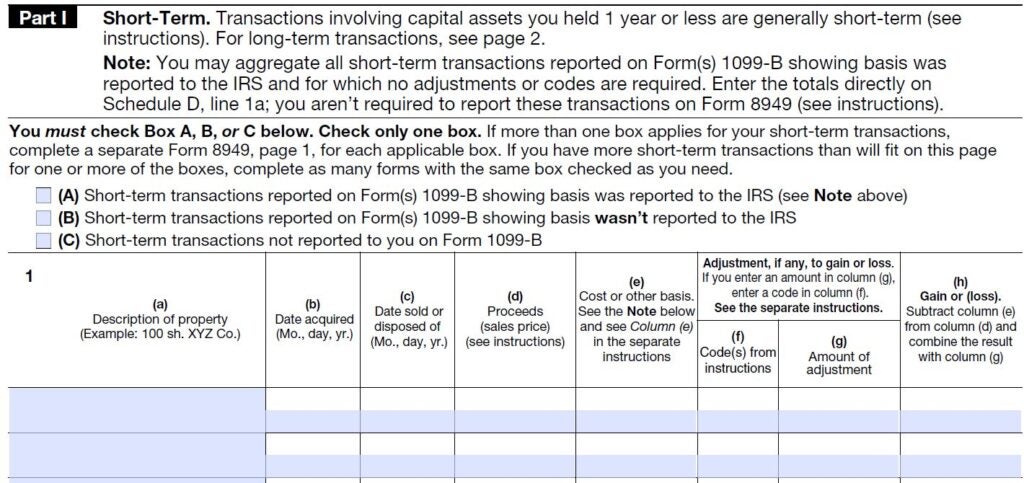

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate